Introduction

Linea, a pioneer in the ZK space delivering a fully EVM-compatible, secure, and performant zkEVM rollup, is launching Linea Ignition campaign designed to boost liquidity depth, DeFi activity, and Linea’s long-term ecosystem growth. This incentive program is a catalyst for our ecosystem, targeting over $1 billion in TVL and distributing 1 billion LINEA tokens from the ecosystem fund managed by the Linea Consortium as rewards.

Linea Ignition campaign is supported by Brevis—a Infinite Compute Layer for Web3 (and Everything). Brevis unlocks a new level of scalability and trust for blockchain, by enabling blockchain applications to run complex, data-intensive computations off-chain while still proving the results on-chain using zero-knowledge proofs generated by Brevis Pico zkVM and zkCoprocessor.

Linea Ignition campaign exemplifies Continuous Protocol Incentivization — a new model allows protocols to distribute rewards sustainably over time based on on-chain behaviors. Brevis enables this process by generating ZK proofs for each LP’s activity (e.g. liquidity provided, volume absorbed), applying predefined reward logic, and enabling end-to-end on-chain verification of reward distribution. By launching the Linea Ignition campaign on Brevis, Linea is showing what it means to put principles into action:

- No centralized rewards database — every calculation is backed by a cryptographic proof published directly on-chain.

- No unnecessary friction — works seamlessly with positions users already hold.

- No compromise on trust — anyone can verify payouts independently.

All these actions make the Linea Ignition campaign fully secure, trustless, and transparent.

Eligibility

Linea Ignition is designed to incentivize liquidity providers (LPs) on Etherex and Lending protocols (Aave and Euler) on Linea. Rewards are allocated in LINEA.

Core Protocols and Pools

Note: IMPORTANT UPDATE:

Euler mUSD (Re7 Labs) pool is eligible for LINEA incentives since September 22, 2025. View detailed rewards schedule.

LPs can earn rewards with the following types of activities:

- Add liquidity in the following pools on Etherex:

- USDC/ETH:

0x90E8a5b881D211f418d77Ba8978788b62544914B - WBTC/ETH:

0xc0cd56e070e25913d631876218609f2191da1c2a - REX/ETH:

0x5C1Bf4B7563C460282617a0304E3cDE133200f70 - USDT/ETH:

0xd5E04ba35908D7bF5BD2eAd7e3e14d21df07DC01(this pair is eligible from September 8, 2025) - ETH/LINEA:

0x73045fe421f1f1719946cc664cf6020b0c183854(this pair is eligible from September 10, 2025) USDC/USDT:(this pair was removed on September 8, 2025)0x35521ec62d91375ac9510d1feefe254b4b582ea0- USDC/mUSD:

0x09666EAF650DC52cece84B1bcD2dd78997D239c7(this pair is eligible from September 15, 2025) - USDT/mUSD:

0x5Dc74003C0a9D08EB750B10ed5b02fA7D58d4d1e(this pair is eligible from September 15, 2025) - mUSD/ETH:

0x6667F117B936F17aA62D0FD3228Ad0db046985E6(this pair is eligible from September 15, 2025) - LINEA/mUSD:

0x76e5D2033268F053CBE8B65aBbD00DB66Fa6D39B(this pair is eligible from September 15, 2025)

- USDC/ETH:

- Supply liquidity in the following lending pools on Aave or Euler:

- USDC pool (Aave)

- WETH pool (Aave)

- USDT pool (Aave)

- WETH vault (Euler):

0xb135dcf653dafb5ddaa93f926d7000aa3222efee - WETH vault (Euler):

0xa8A02E6a894a490D04B6cd480857A19477854968 - WETH vault (Euler):

0xF4712fC5E6483DE9e1Ff661D95DD686664327086 - WETH vault (Euler):

0x8bf8EdC911Ab3f0ea4a27c51Cb88b57ccE5356f1 - WETH vault (Euler):

0x179DfD3eCDC6f5B8F8788584F3289D10c6F1afb8 - WETH vault (Euler):

0x9aC2F0A564B7396A8692E1558d23a12d5a2aBb1F - USDC vault (Euler):

0xfb6448b96637d90fcf2e4ad2c622a487d0496e6f - USDC vault (Euler):

0x14EfcC1Ae56e2fF75204Ef2Fb0DE43378d0beaDA - USDT vault (Euler):

0xcbef9be95738290188b25ca9a6dd2bec417a578c - USDT vault (Euler):

0x085f80Df643307e04f23281F6fdbfAA13865E852 - mUSD vault (Euler):

0xA7ada0D422a8b5FA4A7947F2CB0eE2D32435647d(this pool is eligible for LINEA incentives from September 22, 2025)

Supported Yield Aggregator Vaults

LPs can also get rewards by depositing into the following yield aggregator vaults.

- Euler Earn:

- Beefy:

- Lagoon vault:

Rewards Schedule

Note: The rewards schedule is up to adjustment by the Linea team on a weekly basis.

Epoch: September 1, 2025 - September 7, 2025

Total rewards amount in the epoch: 150,000,000 LINEA

| Protocol | LINEA Rewards Amount |

|---|---|

| Etherex USDC/ETH | 20,250,000 |

| Etherex USDC/USDT | 13,500,000 |

| Etherex WBTC/ETH | 4,500,000 |

| Etherex ETH/REX | 6,750,000 |

| Lending Pools (Aave, Euler)(USDC, USDT, ETH)* | 105,000,000 |

Note: *The reward allocation to each lending pool is dynamically computed based on their actual TVL. See the rewards calculation rules for details.

Epoch: September 8, 2025 - September 14, 2025

Total rewards amount in the epoch: 172,000,000 LINEA

| Protocol | LINEA Rewards Amount |

|---|---|

| Etherex USDC/ETH | 12,800,000 |

| Etherex WBTC/ETH | 9,600,000 |

| Etherex USDT/ETH | 6,400,000 |

| Etherex ETH/REX | 3,200,000 |

| Etherex ETH/LINEA | 12,000,000 |

| Lending Pools (Aave, Euler)(USDC, USDT, ETH)* | 128,000,000 |

Note: *The reward allocation to each lending pool is dynamically computed based on their actual TVL. See the rewards calculation rules for details.

Epoch: September 15, 2025 - September 21, 2025

Total rewards amount in the epoch: 140,000,000 LINEA

| Protocol | LINEA Rewards Amount |

|---|---|

| Etherex USDC/ETH | 2,800,000 |

| Etherex WBTC/ETH | 1,400,000 |

| Etherex USDT/ETH | 2,800,000 |

| Etherex ETH/REX | 1,400,000 |

| Etherex ETH/LINEA | 5,600,000 |

| Etherex mUSD/USDC | 2,800,000 |

| Etherex mUSD/USDT | 2,800,000 |

| Etherex mUSD/ETH | 5,600,000 |

| Etherex mUSD/LINEA | 2,800,000 |

| Lending Pools (Aave, Euler)(USDC, USDT, ETH)* | 112,000,000 |

Note: *The reward allocation to each lending pool is dynamically computed based on their actual TVL. See the rewards calculation rules for details.

Epoch: September 22, 2025 - September 28, 2025

Total rewards amount in the epoch: 70,000,000 LINEA

| Protocol | Linea Rewards Amount |

|---|---|

| Etherex USDC/ETH | 1,400,000 |

| Etherex WBTC/ETH | 700,000 |

| Etherex USDT/ETH | 1,400,000 |

| Etherex ETH/REX | 700,000 |

| Etherex ETH/LINEA | 2,800,000 |

| Etherex mUSD/USDC | 1,400,000 |

| Etherex mUSD/USDT | 1,400,000 |

| Etherex mUSD/ETH | 2,800,000 |

| Etherex mUSD/LINEA | 1,400,000 |

| Lending Pools (Aave, Euler)(mUSD, USDC, USDT, ETH)* | 56,000,000 |

Note: *The reward allocation to each lending pool is dynamically computed based on their actual TVL. See the rewards calculation rules for details.

Epoch: September 29, 2025 - October 5, 2025

Total rewards amount in the epoch: 70,000,000 LINEA

| Protocol | Linea Rewards Amount |

|---|---|

| Etherex USDC/ETH | 1,400,000 |

| Etherex WBTC/ETH | 700,000 |

| Etherex USDT/ETH | 1,400,000 |

| Etherex ETH/REX | 700,000 |

| Etherex ETH/LINEA | 2,800,000 |

| Etherex mUSD/USDC | 1,400,000 |

| Etherex mUSD/USDT | 1,400,000 |

| Etherex mUSD/ETH | 2,800,000 |

| Etherex mUSD/LINEA | 1,400,000 |

| Lending Pools (Aave, Euler)(mUSD, USDC, USDT, ETH)* | 56,000,000 |

Note: *The reward allocation to each lending pool is dynamically computed based on their actual TVL. See the rewards calculation rules for details.

Epoch: October 6, 2025 - October 12, 2025

Total rewards amount in the epoch: 70,000,000 LINEA

| Protocol | Linea Rewards Amount |

|---|---|

| Etherex USDC/ETH | 1,400,000 |

| Etherex WBTC/ETH | 700,000 |

| Etherex USDT/ETH | 1,400,000 |

| Etherex ETH/REX | 700,000 |

| Etherex ETH/LINEA | 2,800,000 |

| Etherex mUSD/USDC | 1,400,000 |

| Etherex mUSD/USDT | 1,400,000 |

| Etherex mUSD/ETH | 2,800,000 |

| Etherex mUSD/LINEA | 1,400,000 |

| Lending Pools (Aave, Euler)(mUSD, USDC, USDT, ETH)* | 56,000,000 |

Note: *The reward allocation to each lending pool is dynamically computed based on their actual TVL. See the rewards calculation rules for details.

Epoch: October 13, 2025 - October 19, 2025

Total rewards amount in the epoch: 70,000,000 LINEA

| Protocol | Linea Rewards Amount |

|---|---|

| Etherex USDC/ETH | 1,400,000 |

| Etherex WBTC/ETH | 700,000 |

| Etherex USDT/ETH | 1,400,000 |

| Etherex ETH/REX | 700,000 |

| Etherex ETH/LINEA | 2,800,000 |

| Etherex mUSD/USDC | 1,400,000 |

| Etherex mUSD/USDT | 1,400,000 |

| Etherex mUSD/ETH | 2,800,000 |

| Etherex mUSD/LINEA | 1,400,000 |

| Lending Pools (Aave, Euler)(mUSD, USDC, USDT, ETH)* | 56,000,000 |

Note: *The reward allocation to each lending pool is dynamically computed based on their actual TVL. See the rewards calculation rules for details.

Epoch: October 20, 2025 - October 26, 2025

Total rewards amount in the epoch: 70,000,000 LINEA

| Protocol | Linea Rewards Amount |

|---|---|

| Etherex USDC/ETH | 1,400,000 |

| Etherex WBTC/ETH | 700,000 |

| Etherex USDT/ETH | 1,400,000 |

| Etherex ETH/REX | 700,000 |

| Etherex ETH/LINEA | 2,800,000 |

| Etherex mUSD/USDC | 1,400,000 |

| Etherex mUSD/USDT | 1,400,000 |

| Etherex mUSD/ETH | 2,800,000 |

| Etherex mUSD/LINEA | 1,400,000 |

| Lending Pools (Aave, Euler)(mUSD, USDC, USDT, ETH)* | 56,000,000 |

Note: *The reward allocation to each lending pool is dynamically computed based on their actual TVL. See the rewards calculation rules for details.

Epoch: October 27, 2025 - November 2, 2025 (extension)

Note: This is a special 1-week extension to the original Linea Ignition program.

Note: Rewards accrued during the extended period still follows a vesting schedule. View the vesting schedule.

Total rewards amount in the epoch: 70,000,000 LINEA

| Protocol | Linea Rewards Amount |

|---|---|

| Etherex USDC/ETH | 1,400,000 |

| Etherex WBTC/ETH | 700,000 |

| Etherex USDT/ETH | 1,400,000 |

| Etherex ETH/REX | 700,000 |

| Etherex ETH/LINEA | 2,800,000 |

| Etherex mUSD/USDC | 1,400,000 |

| Etherex mUSD/USDT | 1,400,000 |

| Etherex mUSD/ETH | 2,800,000 |

| Etherex mUSD/LINEA | 1,400,000 |

| Lending Pools (Aave, Euler)(mUSD, USDC, USDT, ETH)* | 56,000,000 |

Note: *The reward allocation to each lending pool is dynamically computed based on their actual TVL. See the rewards calculation rules for details.

Rewards Calculation

Etherex Pools

Note: For Etherex pools, the displayed APR on the UI is just an estimate using last week rewards and current TVL. The actual APR of your LP position depends on the swap volume your liquidity absorbs and the corresponding swap slippage.

Rewards for each LP are allocated based on the swap volume generated by their liquidity and the slippage of each swap. The detailed reward formula is as follows.

For each pool and each epoch (1 epoch = 1 week), suppose there are $K$ swaps and $N$ LPs.

Then LP $i$’s reward for the pool and the epoch can be calculated as

$$ R_i=R_{total}\cdot\frac{\sum_{k=1}^KV_{(i,k)}F(\Delta P_k)}{\sum_{j=1}^N \sum_{k=1}^KV_{(j,k)}F(\Delta P_k)} $$

- $R_{total}$ is the total amount of LINEA rewards allocated to the pool during the epoch.

- $V_{(i,k)}$ is the volume absorbed by LP $i$ in swap $k$.

- $\Delta P_k$ is the actual slippage of swap $k$. For example, $\Delta P_k=0.003$ means that the execution of swap $k$ moves the price by 0.3% (either price up or price down).

- $F(\Delta P_k)=a\cdot(\Delta P_k)^b$ is a function of $\Delta P_k$ where parameter $a$ and $b$ are decided by the Linea team.

Note: Note: The reward reward formula and parameters might be updated on a weekly basis by the Linea team.

Lending Pools

Note: Looping or leveraged lending may be penalized. Please see reward details below.

For lending pools (Aave and Euler), the following reward calculation rules are applied.

Step 1: Compute Reward Allocation for Each Pool

For each epoch, there is a total reward amount $R_{total}$ for all the lending pools.

For each pool $k$, its weight $W_k$ during the epoch can be calculated as

$$ W_k=\beta_k Q_k *TVL^k_a $$

- $\beta_k$ is a per-pool constant (defined by the Linea team).

- $TVL^k_a$ is the actual effective TVL TWA (Time-Weighted Average) during the epoch in pool $k$.

- $TVL^k_t$ is the target TVL for pool $k$ (defined by the Linea team).

- $Q_k=Q_{min}+(Q_{max}-Q_{min}) \exp(-\alpha \frac{TVL^k_a}{TVL^k_t} )$, where $Q_{min}$ is the min ratio (e.g., 0.02) and $Q_{max}$ is the max ratio (e.g., 0.15). $\alpha >0$ is a sensitivity parameter (e.g., $\alpha=2$).

Then the reward allocated to pool $k$ during the epoch can be calculated as

$$ R_k = R_{total}*\frac{W_k}{\sum_{j} W_j} $$

Note: Each “pool” as mentioned above corresponds to an asset (e.g., USDC). If there are multiple lending protocols that support the same asset (e.g., Aave USDC and Euler USDC), the above formula can be used to calculate the reward allocation for each asset (where $TVL^k_a$ is the sum of actual TVLs from these protocols). Then the rewards are further split to different lending protocols proportional to their actual TVLs.

Step 2: Compute Each Users’ Rewards in a Lending Pool

For each pool $k$ and each epoch, the reward for LP $i$ can be calculated as

$$ R^k_{i}=R_k\cdot\frac{S^k_i}{\sum_{j=1}^N S^k_j} $$

- $R_k$ is the reward allocated to the pool (computed according to the formulas in Step 1).

- $S^k_i$ is the eligible holding by LP $i$ in pool $k$, calculated as $S_i^k = \max (0, c_i^k - \frac{d_i^k}{l_k})$, where

- $c_i^k$ is the supplied collateral (aToken/eToken) TWA by LP $i$ in pool $k$

- $d_i^k$ is the debt (dToken) TWA by LP $i$ in pool $k$

- $l_k$ is the liquidation threshold for pool $k$ (e.g., 78% for Aave USDC/USDT pool, 83% for Aave ETH pool). For all Euler pools, the liquidation threshold is hardcoded to 92%.

Note: With the above formula of eligible holding, users who loop the collateral with the debt of the same asset will be penalized.

Note: Note: The reward reward formula and parameters might be updated on a weekly basis by the Linea team.

Campaign Information

Campaign Website

LPs can review the campaign information and view/claim their rewards directly through the campaign website: https://linea-ignition.brevis.network.

Rewards Update Epoch

Rewards are updated on a weekly basis. After each week ends, Brevis will retrospectively attest the rewards for all LPs for the past week. LPs should see their rewards for the past week updated on each Monday or Tuesday.

The start of each epoch (and the end of last epoch) is the UTC 00:00:00 every Monday.

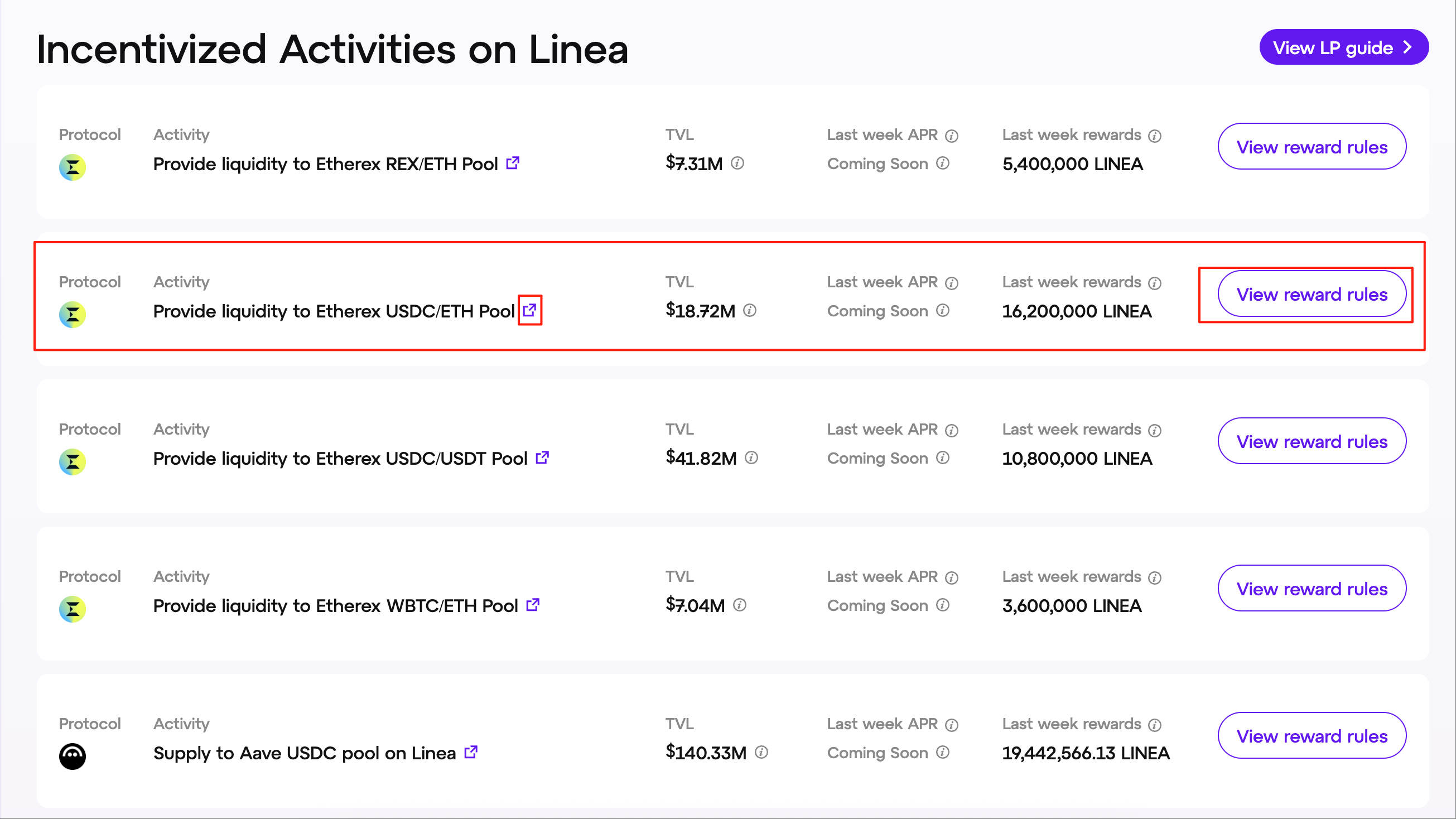

Last Week Rewards

For Etherex pools: The “Last Week Rewards” displayed on the UI are the rewards allocated to the DEX pool during the past week.

For Aave and Euler pools: The “Last Week Rewards” displayed on the UI for each lending pool are the actual rewards allocated to the pool based on the calculated weights during the past week. View the rewards calculation rules for lending pools for details.

TVL

The displayed TVL of Etherex pools represents the total liquidity provided to this pool by all LPs, including both in-range and out-of-range liquidity.

The displayed TVL of Aave/Euler pools represents the total collateral value supplied to this pool by all LPs.

APR

The APR shown on the UI is an estimate value based on last week’s rewards and the current TVL, which is estimated as:

Note: For Etherex pools, the actual APR of your LP position depends on the swap volume your liquidity absorbs and the corresponding swap slippage.

End Date

Campaign end date: October 26, 2025.

Claim Rewards and Vesting

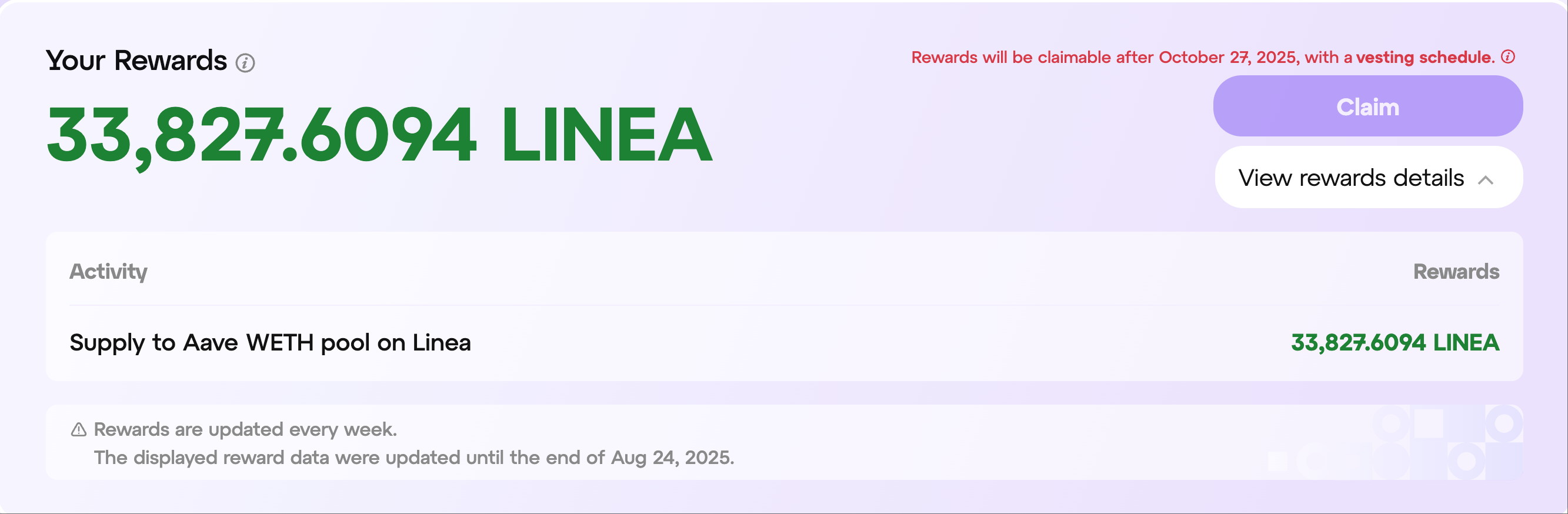

On the campaign page, you can view your cumulative rewards up to the end of the past week.

All rewards earned in the Linea Ignition campaign are vested.

Vesting for Regular Sessions (until Oct 26, 2025)

Before October 27, 2025, all rewards are locked, and the claim function is disabled. LPs can only view the cumulative rewards amount.

After October 27, 2025, rewards claim will open according to the following vesting schedule:

- On October 27, 40% of rewards will be unlocked immediately and available for claim.

- The remaining 60% of rewards will be unlocked linearly per day over the next 45 days after October 27, 2025.

Vesting for Extended Session (Oct 27 - Nov 2)

For rewards accrued during the extended session, rewards claim follows the below vesting schedule:

- On November 3, 40% of your rewards in the extended session will be unlocked immediately and available for claim.

- The remaining 60% rewards will be unlocked linearly per day over the next 45 days after November 3, 2025.

MetaMask USD (mUSD)

MetaMask USD (mUSD) is a cryptocurrency stablecoin, launched by MetaMask in September 2025. Linea Ignition Campaigns support various mUSD pools. For more details about MetaMask USD, please refer to this page.

Check Incentivized Activities

Welcome to the Linea Ignition campaign page.

Here, you can view all incentivized activities, including their name, TVL, last week’s APR, and last week’s rewards. You can participate in an activity by clicking the link next to the name, and review the reward rules by clicking the button on the right.

View/Claim Rewards

Note: All rewards earned in the Linea Ignition campaign are vested. 40% of your rewards can be immediately claimed after October 27, 2025. The remaining 60% rewards are unlocked linearly daily over the next 45 days after October 27, 2025.

Before October 27, 2025, the claim function is disabled. You can only view your total accumulative rewards and the detailed rewards for each activity where you have rewards.

After October 27, 2025, the “Claim” button becomes active, after which you can view your claimable rewards that have been unlocked and claim them directly by clicking the “Claim” button.

NOTE: The reward amount shown here is an estimate and may be adjusted slightly before the end of this incentive program.

NOTE: Rewards are updated on a weekly basis.

Community Support

If you encounter any issues during the Linea Ignition campaign period, feel free to join the Brevis or Linea community to get support.

Dive deeper into Brevis:

- Website: https://brevis.network/

- X: https://twitter.com/brevis_zk

- Discord: https://discord.gg/vNUY3AUcvt

- Telegram: https://t.me/brevisnetwork

- Pico zkVM Docs: https://pico-docs.brevis.network/

- zkCoprocessor Docs: https://coprocessor-docs.brevis.network/

- Talk to a builder: https://form.typeform.com/to/lduiliob\

Dive deeper into Linea

- Website: https://linea.build/

- X: https://x.com/LineaBuild

- Discord: https://discord.com/invite/linea

- Developer Docs: https://docs.linea.build/